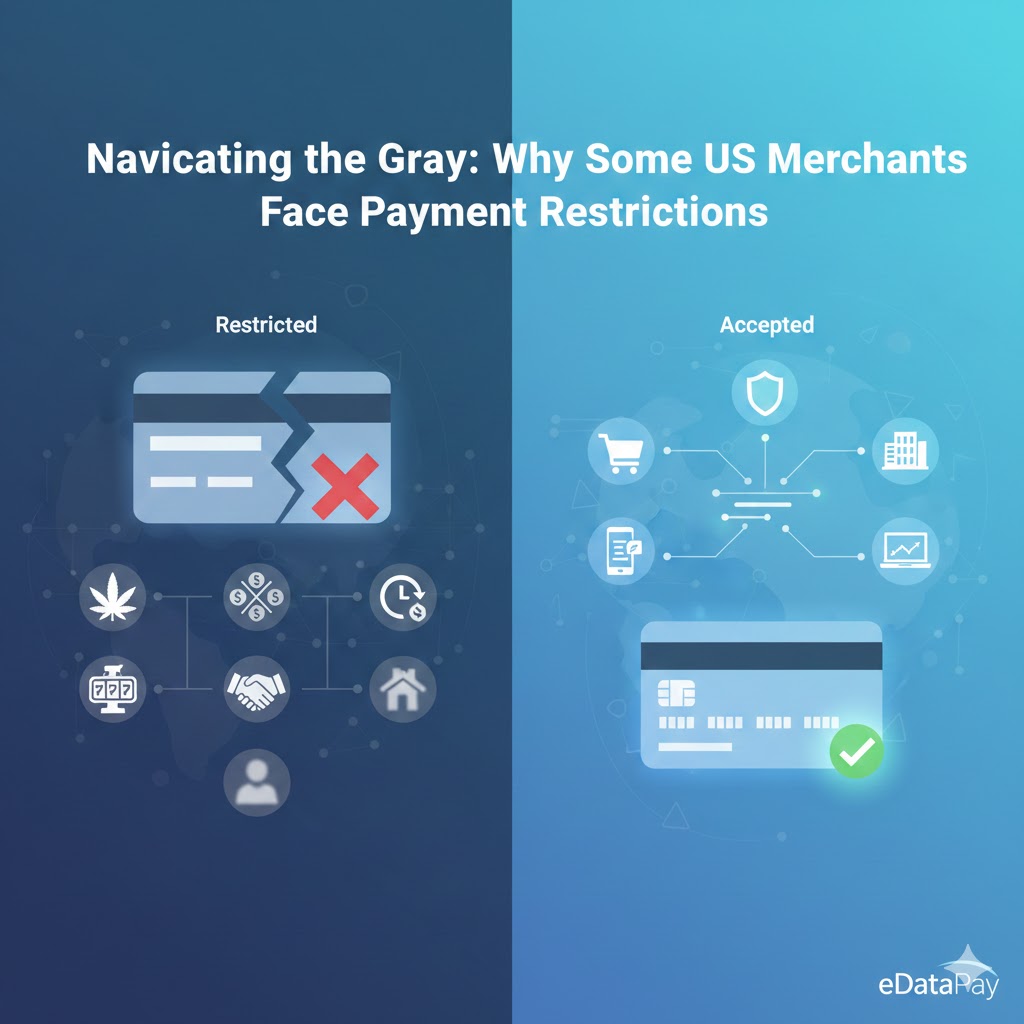

Why Some US Merchants Face Payment Restrictions

Navigating the Gray: Why Some US Merchants Face Payment Restrictions In the world of US payments, not all businesses are treated equally. You might have a perfectly legal business, yet find yourself hitting a wall when trying to secure a merchant account. In the industry, these businesses are often labeled as “restricted” or “high-risk.” But […]

money-transmitter-bonds-guide

eDataPay’s Playbook: Money Transmitter Bonds & How a PSP Builds a 40-State MSB for Fiat + Crypto Merchants By eDataPay • Updated Jan 2026 • Estimated read: 9 minutes Summary: This guide explains what money transmitter bonds are, who needs them, and how eDataPay (a PSP) can add a licensed MSB capability across multiple […]

modern-payment-methods-edatapay

Introduction to Modern Payment Methods by eDataPay As commerce moves faster and customers expect simple, secure checkout, businesses must adopt modern payment methods. eDataPay helps you accept the payments customers prefer across devices, borders, and channels. Quick summary: Learn 8 payment types and how eDataPay makes each one easy, secure, and scalable. {#main-infographic alt=”Introduction to […]

How to get a merchant account today

eDataPay and eData Financial Group are running limited‑time promotions that make it dramatically cheaper for businesses to start accepting cards and digital payments, including 0% processing options, free smart terminals, and full POS rentals starting around the cost of a daily coffee. These programs are built on compliant surcharge and cash‑discount structures that shift or […]

Court Battle That Redraw the Lines Between Finance and Gambling

The Fight for Financial Supremacy: Why Kalshi’s War Against State Regulators is a Defining Moment for Fintech The regulatory landscape governing emerging financial products is often a patchwork of outdated statutes and jurisdictional turf wars. Nowhere is this struggle more evident than in the aggressive, multi-front legal battle being waged by derivatives exchange KalshiEX LLC […]

Business Needs a Solution Like eDataPay Crypto Payments NOW

Crypto Payments Explained: Why Your Business Needs a Solution Like eDataPay Crypto Payments NOW Cryptocurrency is no longer an experiment, it’s payments channel your customers already use. If your checkout still relies only on cards and bank rails, you’re leaving speed, margin, and international buyers on the table. eDataPay makes it simple for merchants to […]

German fintech Wirecard collapses amid fraud allegations

A Bankrupt Fintech’s Big Sponsor The Aftermath of Wirecard’s Collapse and eDataPay’s Role in Global Payments Updated: February 18, 2025 Wirecard’s Ongoing Scandal In 2020, Wirecard AG, once a leading German fintech company, collapsed into insolvency after revealing a staggering €1.9 billion discrepancy in its accounts, which it suspected might not exist at all. This […]

High-Risk Merchant Accounts: Fast, Secure, Global Approvals with eDataPay

High-Risk Doesn’t Mean High-Frustration If you sell collectibles, run online gaming, market nutraceuticals, or manage subscription services, you already know the drill: banks label you “high-risk,” processors push you aside, and your growth stalls. Yet the global audience—and the revenue—are waiting. Enter eData Financial Group LLC and our flagship platform, eDataPay.com. We thrive where traditional […]

Vamp EU Merchants Risk

Navigating Visa’s VAMP: Rethinking High-Risk Merchant Processing in the EU The landscape of high-risk merchant processing is experiencing a seismic shift with Visa’s rollout of the Visa Acquirer Monitoring Program (VAMP), set to fully enforce stringent thresholds by 2026. Historically, EU banks have been a favored solution for cross-border merchants, particularly in high-risk sectors such […]

Payoneer acquires optile

Payoneer Acquires optile to Strengthen Global Payment Infrastructure In a move that reflects the fast-paced evolution of digital payments, Payoneer, a leading provider of cross-border payment solutions, has acquired optile, a Munich-based startup specializing in open payment orchestration. This strategic acquisition highlights the growing consolidation in the fintech space and reinforces Payoneer’s commitment to expanding […]