Navigating the Gray: Why Some US Merchants Face Payment Restrictions

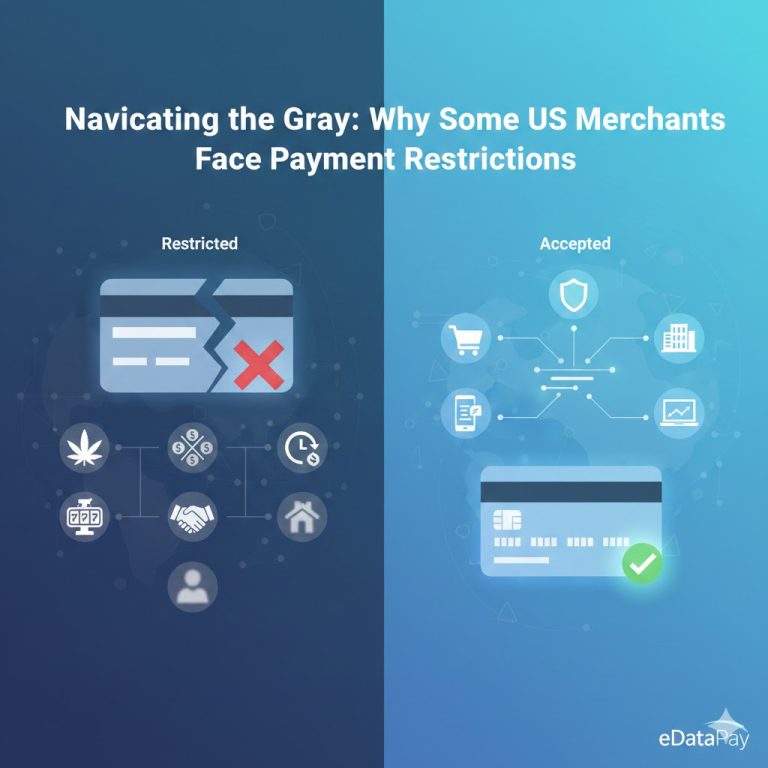

In the world of US payments, not all businesses are treated equally. You might have a perfectly legal business, yet find yourself hitting a wall when trying to secure a merchant account. In the industry, these businesses are often labeled as “restricted” or “high-risk.”

But what does that actually mean for your bottom line? At eDataPay, we believe in transparency. Understanding why banks categorize certain industries this way is the first step toward finding a sustainable payment solution.

The Anatomy of “High-Risk”

Banks and processors don’t restrict industries on a whim. The “restricted” label usually stems from five core pressure points:

-

Regulatory Complexity: Industries like healthcare, gambling, and financial products move through a maze of heavy regulation.

-

Federal vs. State Conflicts: The most famous example is Cannabis/CBD. While legal in many states, federal illegality creates massive hurdles for national card networks.

-

Fraud & Chargeback Exposure: Verticals like online dating, travel, and supplements historically see higher rates of “friendly fraud” and customer disputes.

-

Reputational Risk: Banks are sensitive to brand image. Even if a business is legal (e.g., adult entertainment or “wonder drug” marketing), it may carry a media risk banks want to avoid.

-

AML & KYC Concerns: Any business involving large cross-border flows or virtual currency triggers intense Anti-Money Laundering (AML) and Know Your Customer (KYC) scrutiny.

Common Restricted Categories

Every bank has its own “risk matrix,” but several sectors consistently appear on the restricted list:

| Industry | Primary Risk Drivers |

| Cannabis & CBD | Federal illegality and complex licensing requirements. |

| Gambling & Gaming | UIGEA compliance and high dispute rates. |

| Money Services (MSB) | AML/KYC obligations and pseudonymous value transfers. |

| Short-Term Lending | High consumer-protection scrutiny and debt-related risks. |

| Adult & Dating | Elevated fraud rates and content moderation challenges. |

| Subscription Services | Recurring billing models and delayed delivery risks. |

It’s All in the Code: Understanding MCCs

Your business isn’t just a name to a bank; it’s a Merchant Category Code (MCC). These four-digit numbers tell the bank exactly what you do—and how much risk you bring.

For example, codes like 7273 (Dating/Escort Services) or 7995 (Betting) act as immediate flags for enhanced monitoring. If your MCC is miscoded—whether by accident or to hide prohibited activity—you risk criminal bank-fraud prosecutions and the immediate loss of your processing rights.

The eDataPay Difference: Moving Beyond “No”

At eDataPay, our goal isn’t just to filter businesses out; it’s to find the right path forward. We separate what is truly prohibited from what can be managed with the right structure.

Our Approach Includes:

-

Compliance First: We validate your licenses and registrations upfront so there are no surprises during the boarding process.

-

Specialized Rails: When mainstream banks say no, we tap into specialized acquirers and high-risk programs designed specifically for your industry.

-

Active Monitoring: We don’t just “set and forget” your account. We provide ongoing chargeback control to protect your merchant health and your relationship with the bank.

The Bottom Line: If you’ve been told you can’t process cards, it might just mean you haven’t found the right partner. With the correct licensing and risk controls, many restricted businesses can find a stable home.

Is your business currently categorized as high-risk? Contact eDataPay today to explore our specialized payment integrations and secure next-day deposits.