Why High-Risk Merchants Choose eDataPay

Why High-Risk Merchants Choose eDataPay

At eData Financial Group LLC, we specialize in supporting restricted and elevated-risk merchants by offering reliable, secure, and flexible merchant accounts through our platform at eDataPay.com. Whether you're selling collectibles, offering seminars, marketing vitamins, managing subscription services, or working in the adult, dating, or gaming verticals — we help you get approved.

Accept Payments for Your High-Risk Business – Fast, Secure, and Global

Many traditional banks and processors avoid these industries. But we don’t. We embrace innovation and work with multiple acquiring banks, both domestic and international, that understand your business model. Our underwriting and risk teams are trained in complex MCCs and will support you from application to payout.

High-risk merchants choose specific eDataPay and it’s Global payment processors because traditional banks and standard processors are often unwilling to work with them due to the increased perceived risk.1 Here’s a breakdown of why:

Why a business might be classified as “high-risk”:

-

Industry Type: Certain industries are inherently considered high-risk due to a higher likelihood of fraud, chargebacks, or regulatory scrutiny. Examples include online gambling, adult entertainment, CBD/cannabis products, firearms, travel agencies, nutraceuticals, and credit repair services.

-

Business History: New businesses without a proven track record, or those with a history of frequent chargebacks, high refund rates, or financial instability (e.g., poor credit), are often flagged as high-risk.

-

Transaction Characteristics:

-

Card-not-present transactions: Online, mail, or telephone orders have a higher risk of fraud compared to in-person transactions.5

-

High average ticket amounts: Larger transactions carry more financial risk if a chargeback occurs.

-

High sales volume or erratic sales: Inconsistent or very high sales volumes can be seen as a risk indicator.

-

Subscription-based services: Recurring payments can lead to higher chargeback rates.

-

-

Geographical Location: Businesses operating in certain countries or engaging in significant international sales may be deemed higher risk due to varying regulations and fraud rates.

-

Regulatory Environment: Industries with evolving or strict regulations can pose greater risks for processors due to potential legal issues and compliance challenges.

Why high-risk merchants choose specialized processors:

-

Acceptance: Specialized high-risk payment processors are willing to take on businesses that traditional banks and standard processors decline.

-

Tailored Solutions: These processors understand the unique challenges of high-risk industries and offer solutions designed to mitigate those risks, such as advanced fraud detection tools, robust chargeback management, and compliance support.

-

Risk Mitigation: While high-risk accounts often come with higher fees (setup, monthly, processing, and chargeback fees) and stricter terms (like rolling reserves where a percentage of transactions is held), they provide essential access to payment processing that allows these businesses to operate.

-

Experience and Expertise: Processors specializing in high-risk businesses have experience navigating the complexities and can offer guidance on best practices for risk management.

In essence, specialized payment processors fill a critical need for businesses that would otherwise struggle to accept credit and debit card payments, by providing the necessary infrastructure and risk management despite the elevated risk.

High-Risk Merchant Accounts – Accept Payments Fast, Securely, and Globally with eDataPay

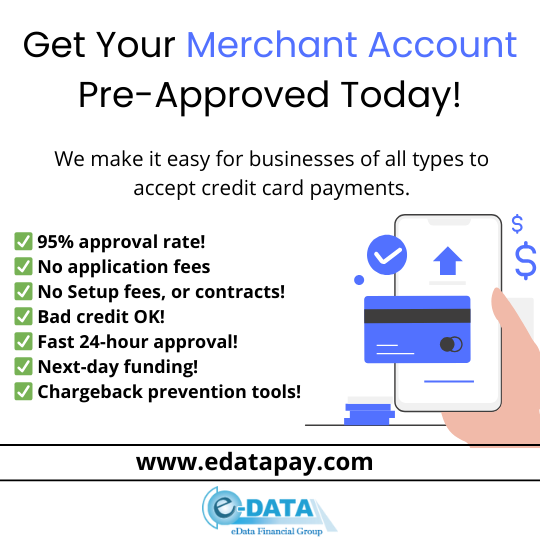

Are you running a business that falls into a high-risk category and struggling to get approved for payment processing? eData Financial Group LLC, through eDataPay.com, specializes in helping merchants like you secure reliable, flexible, and secure merchant accounts, quickly and easily.

Why High-Risk Merchants Choose eDataPay

While many banks and traditional processors shy away from industries they consider high-risk, we do exactly the opposite. We embrace innovation, risk management, and secure payments processing for restricted MCCs.

Whether your business involves online dating, iGaming, nutraceuticals, seminars, telemarketing, or precious metals, our specialized underwriting and risk teams understand your needs. We support merchants with elevated-risk profiles and complex MCC codes, enabling fast approvals and seamless global payments.

Industries We Proudly Support

Dating & Matchmaking Services (MCC 7273)

iGaming, Gambling & Casinos (MCC 7995)

Nutraceuticals & Supplements (MCC 5122, 5912)

Collectibles & Antiques (MCC 5999 / 5972)

Seminar & Course Marketers (MCC 7399)

Telemarketing & Outbound Sales (MCC 5966)

Precious Metals & Jewelry Dealers (MCC 5094)

SEO & Digital Marketing Agencies (MCC 7392)

Our Advanced Merchant Solutions Include:

Real Underwriting Experts: Work directly with specialists who know your MCC code and industry.

Multi-Bank Processing Redundancy: Gain approvals faster through our extensive network of domestic and international acquiring banks.

Payment Gateway & Switch Integration: Seamlessly integrate your systems for streamlined payment processing.

Multi-Currency Global Accounts: Accept payments in multiple currencies—USD, EUR, GBP, and soon, crypto.

Chargeback & Fraud Protection: Advanced tools to minimize your risk and protect your revenue.

Cutting-Edge Technology: Full CRM integration, digital signatures, and API-ready systems.

Why Choose eDataPay Over Other Providers?

Unlike other high-risk payment processors, we don’t waste your time with hidden fees or complicated terms. We provide:

Transparent, straightforward onboarding

No upfront fees—ever

Dedicated, personalized support

Fast approvals—start processing within 24–72 hours

Apply Now & Start Processing Quickly!

Tired of getting declined due to your MCC? Let eDataPay handle your merchant account needs.

📌 Apply Online Now: Click Here to Apply

📩 Or Contact Our Sales Team: sales@edatapay.com

Make eDataPay your go-to solution for high-risk merchant processing and see why merchants around the globe trust us with their business payments.

Ready to Get Started?

👉 Apply Online Today!

📧 sales@edatapay.com

Fast Approvals | Secure Payments | Reliable Merchant Accounts – eDataPay.com

We Are #1

US and International Merchant Account Provider!

At eDataPay, we’re experts with over 18 years of experience, providing turn key the technology set up on proprietary business software and smart business set up to Ignite smooth and fast Payments by eData Merchant services for large established business and start-up businesses. We have the perfect technology any small business need today to complete as or with the established organizations and Brands. Our success is built on our client’s success. Our consultants provide support to clients through consultations in specific areas and for specific requirements. We create for our clients’ long-term results that continually drive improvement and value.

We also help with early stages of a business and provide change management services for more established organizations, resulting in faster return on investment and value.

Our clients work with EdataPay without long-term contracts. Flexible consulting agreements and price plans are offered. Clients rely on EdataPay consultants as needed for specific tasks and projects.

Our management consulting services focus on our clients’ most critical issues and opportunities: sales, customer acquisitions, strategy, marketing, SEO, Social Media Management, Corporation Services, Content, operations, worldwide merchant processing, technology, transformation, advanced analytics, and sustainability across all industries and geographies. We bring deep, functional expertise, but are known for our holistic perspective: we capture value across boundaries and between the silos of any organization. We have proven a multiplier effect from optimizing the sum of the parts, not just the individual pieces.