Credit Card Payments Processing 101

So a few years ago, when I first started looking into the payments industry, I was intrigued by the growing wave of private financings — in unicorns such as Stripe and Adyen— not to mention the relatively successful IPO of Square . Fast forward just a few years and Stripe is now a $36 billion company, Adyen is a $23 billion company, and Square’s market cap peaked at one point above $40 billion! But I digress…

At the time, when I started to dig into some of these names, to figure out what they did, I quickly realized I was in over my head. Why did it seem like all of these companies were called processors? How did they compare to legacy processors, such as First Data and Worldpay? And where did Visa and MasterCard fit into the equation, because weren’t they also important?

The payments ecosystem explained

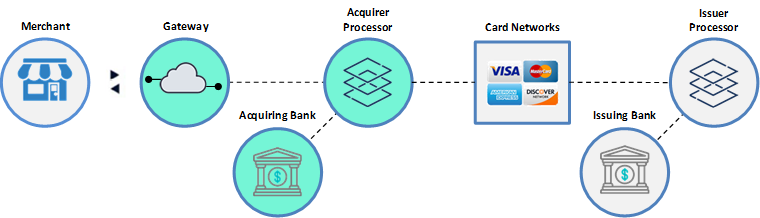

As with most industries, the payments industry appears to be simple but is actually quite complex. We consumers observe only the tip of the iceberg in our everyday lives — our credit card purchases are completed in seconds, we see only the final product, but under the surface lies an entire ecosystem of players (see title graphic).

- Merchant: Merchants sell good or services via physical or online storefronts.

- Payment Gateway: Software or API that accepts credit card transaction information from the card reader (either a POS terminal or online checkout page) and securely communicates to the credit card processor. Examples: Stripe, PayPal, Adyen, Braintree.

- Acquiring Bank: Often called the “merchant acquirer,” acquiring banks (either directly or through an ISO) sign-up and onboard merchants to provide them with a merchant account. The merchant account is strictly used to receive funds from settlement (more on that later). Without a merchant account, the merchant cannot accept credit card payments. Examples: Chase Paymentech, Bank of America Merchant Services, First Data, Worldpay, Global Payments, Adyen.

- Acquirer Processor: Also called the “front-end processor,” acquirer processors serve a technical role, transmitting data from the gateway to the card networks (and back). Examples: First Data, Worldpay, Elavon, Chase Paymentech, Global Payments.

- Card Networks: Card networks supply the electronic infrastructure that enables the processors and banks to communicate and process transactions in real-time. They also set the rules and standards for its network participants. Examples: Visa, Mastercard, AmEx, Discover.

- Issuing Bank: This is the brand on your credit card. Issuing banks underwriter their cardholders and provide them with credit accounts. Examples: Chase, Citi, Capital One, Bank of America, AmEx.

- Issuer Processor: Issuer processors provide several services to issuing banks, including card approval authorizations and funds settlement. Examples: TSYS, Fiserv, Fidelity National Information Services (FIS).

The most confusing part about the payments processing ecosystem is that several companies play more than one role, and some of them partner or resell services on behalf of others.

Navigating the Confusion

A few things to keep in mind when trying to figure out how a payments company fits into the payments processing ecosystem.

- There are really only 5 true Acquirer Processors in the US — they include First Data, Worldpay (which as of 2017 includes US-based Vantiv), Global Payments (which as of 2019 includes TSYS), Elavon, and Chase Paymentech. Important to remember because a Google search for “top payment processors” will probably result in a host of other companies such as PayPal, Stripe, and Square. Quick side note: Adyen and Checkout.com, which originated from Europe, also have true processing capabilities in the US.

- The Acquirer Processors are fairly vertically integrated — the Acquirer Processors I mentioned above each have capabilities that span beyond just processing — they double as the Acquiring Bank and sometimes even offer a payment Gateway (among other merchant services). First Data is a prime example. It is one of the largest Acquirer Processors, one of the largest Acquiring Banks, and can also provide a Gateway (through one of its acquired subsidiaries). To further complicate things, First Data is now a part of Fiserv, which itself serves as an Issuer Processor.

- True merchant acquirers are registered “member banks” of the card networks — this includes the large processors (which double as Acquiring Banks), as well as several other non-processor institutions (e.g., Bank of America Merchant Services or Wells Fargo). MasterCard lists its registered merchant acquiring banks, while Visa provides a registry of service providers, which requires a bit more effort to filter through. Notably, merchants often obtain merchant accounts through an ISO (or independent sales organization) and there’s sometimes confusion as to whether the ISO is a registered acquiring bank. ISOs are not acquiring banks — they are sponsored to sell merchant accounts on behalf of the member banks.

- Companies that are colloquially (but incorrectly) labeled as processors are often actually ISOs or PayFacs — for example, PayPal, Stripe, and Square partner with one of the aforementioned Acquirer Processors to process their transactions. PayPal’s and Stripe’s transactions are processed by First Data, Square’s transactions are processed by Chase Paymentech, and Braintree’s transactions are processed by either First Data or Chase Paymentech. So even though, a merchant may think that Square is its processor, Square provides (among other services) a connection to Chase Paymentech, which is the true processor of the credit card payments the merchant accepts. Quick side note: PayFacs are Payment Facilitators, a key industry trend I’ll discuss in a future post.

Lastly, just to close the loop on this discussion of the key players and their roles in the payment processing ecosystem, it’s sometimes helpful to see how the key players work together to complete Authorizations and Settlements.

Credit Card Authorization

Authorizations are real-time decisions that permit/deny a cardholder from paying with a credit card.

Credit Card Settlement

Settlements occur daily to transfer funds from the cardholder’s bank account to the merchant’s bank account.

A lot to digest here, especially if you’re just starting to look into the payments industry. There are a lot of interesting business models out there and I’ll try to dissect them in future posts, but it’s helpful to first familiarize yourself with the various players and how they work together. Hope this helps to shorten the learning curve.