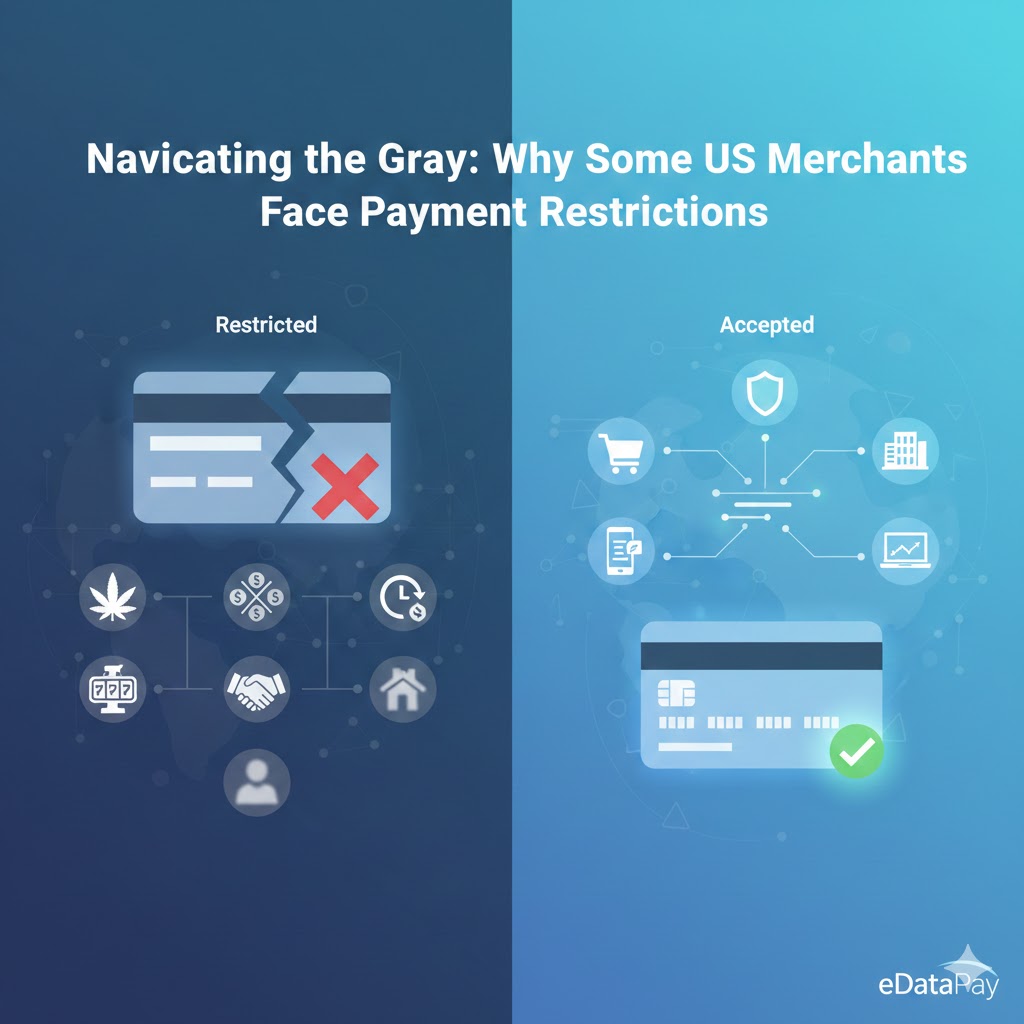

Why Some US Merchants Face Payment Restrictions

Navigating the Gray: Why Some US Merchants Face Payment Restrictions In the world of US payments, not all businesses are treated equally. You might have a perfectly legal business, yet find yourself hitting a wall when trying to secure a merchant account. In the industry, these businesses are often labeled as “restricted” or “high-risk.” But […]

Crypto Payments for SMBs: Lower Fees, Faster Funds, Global Customers

modern-payment-methods-edatapay

Introduction to Modern Payment Methods by eDataPay As commerce moves faster and customers expect simple, secure checkout, businesses must adopt modern payment methods. eDataPay helps you accept the payments customers prefer across devices, borders, and channels. Quick summary: Learn 8 payment types and how eDataPay makes each one easy, secure, and scalable. {#main-infographic alt=”Introduction to […]

Stripe CBD

Stripe and CBD Cards Processing online Stripe does not permit the sale of CBD products on its platform, categorizing CBD businesses as high-risk and restricted. Attempting to process CBD payments through Stripe (including Shopify Payments, which is powered by Stripe) is a violation of their terms of service and can lead to account suspension or termination, with […]

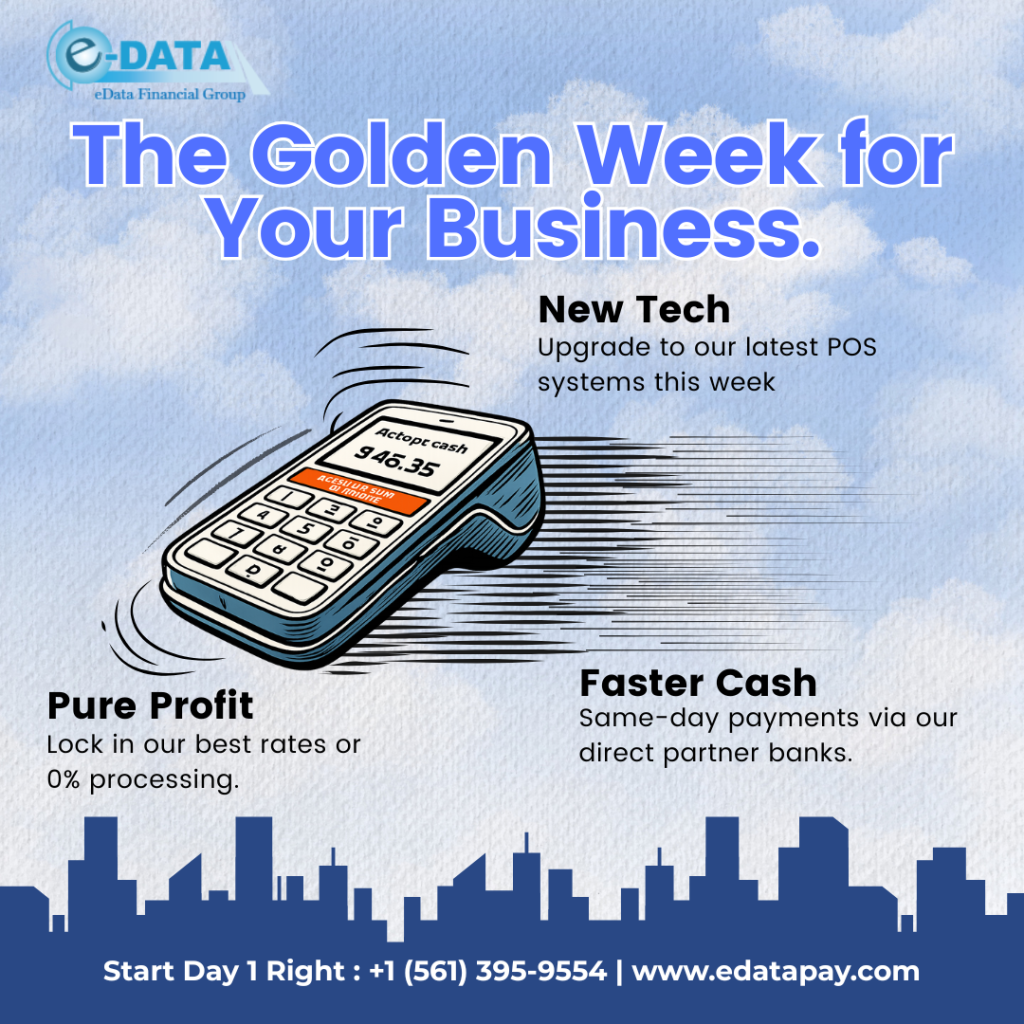

How to get a merchant account today

eDataPay and eData Financial Group are running limited‑time promotions that make it dramatically cheaper for businesses to start accepting cards and digital payments, including 0% processing options, free smart terminals, and full POS rentals starting around the cost of a daily coffee. These programs are built on compliant surcharge and cash‑discount structures that shift or […]

Court Battle That Redraw the Lines Between Finance and Gambling

The Fight for Financial Supremacy: Why Kalshi’s War Against State Regulators is a Defining Moment for Fintech The regulatory landscape governing emerging financial products is often a patchwork of outdated statutes and jurisdictional turf wars. Nowhere is this struggle more evident than in the aggressive, multi-front legal battle being waged by derivatives exchange KalshiEX LLC […]

Emerging Global Payment Trends to Watch in 2024: Stay Ahead with eDataPay

In 2024, businesses must adopt digital payments, cryptocurrency acceptance, and advanced POS systems to stay competitive. eDataPay offers secure, global, and integrated payment solutions to enhance efficiency and customer satisfaction.

Why Florida Businesses Are Switching to eDataPay

Why Florida Businesses Are Switching to eDataPay for Smarter Payment Processing and Business Loans in 2025 – 2026. In Florida’s booming economy—where tourism, real estate, and e-commerce drive billions in revenue—merchants face relentless pressure from rising processing fees, outdated tech, and cash flow crunches. If you’re a retailer in Palm Beach County, a restaurateur in […]

EdataPay Complete Global Payment Solution for Modern Businesses

Complete Global Payment Solution for Modern Businesses Running a business today means thinking beyond borders. Customers expect fast, secure, and seamless payment experiences. whether they’re paying online, in-store, or on their mobile device. For business owners, that means choosing a payment partner that can handle it all. That’s exactly why **EdataPay** exists? eData Global Payments […]

German fintech Wirecard collapses amid fraud allegations

A Bankrupt Fintech’s Big Sponsor The Aftermath of Wirecard’s Collapse and eDataPay’s Role in Global Payments Updated: February 18, 2025 Wirecard’s Ongoing Scandal In 2020, Wirecard AG, once a leading German fintech company, collapsed into insolvency after revealing a staggering €1.9 billion discrepancy in its accounts, which it suspected might not exist at all. This […]